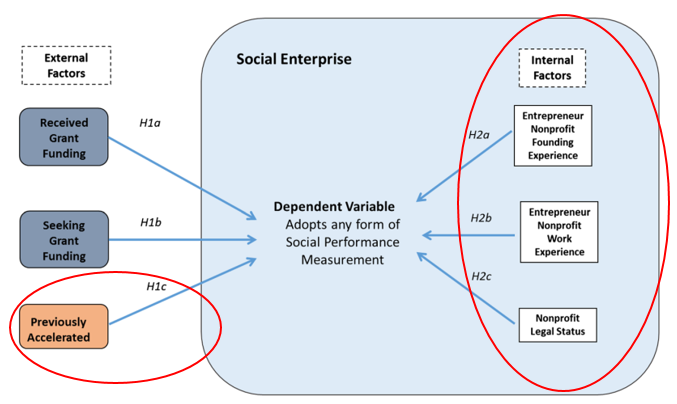

This post was first published on the Asian Venture Philanthropy Network blog on October 2, 2017 Everyone in the field of social entrepreneurship has been talking about social performance measurement for the past few years. Venture philanthropy organizations, impact investors, entrepreneurial ecosystem networks, and consulting firms are continually developing new tools, frameworks, and approaches to measure social performance. AVPN also offers a helpful guide, along with multiple case studies, and other resources for their members to measure the social performance of their portfolio companies. But, while the different groups of actors that support social entrepreneurs have all been talking about the importance of social performance measurement, what about the entrepreneurs themselves? In this study, I try to examine the internal and external factors associated with the adoption of social performance measurement practices, using a large sample of over 1800 social ventures, with some interesting results. Diverse Expectations by Funders and Social Purpose Organisations on Impact Measurement Since these ventures were relatively young (median age of 1 year), only about one-third of the companies in the sample reported measuring their social performance. After assessing the expectations of different types of impact-related funders, I realize that venture philanthropy funders place a high value on social impact, and typically expect their portfolio companies to measure their social performance. For example, Investisseurs & Partenaires (I&P) worked with its investee IPDEV to identify a small, specific set of social indicators that were most relevant to its business, and then developed clear reporting guidelines for the social enterprise. Moreover, performance measurement is a potential way to screen potential investees. Social entrepreneurs may also be exposed to these practices if they participate in an accelerator or other training program. On the other hand, Social Purpose Organisations (SPOs) has been experimenting with various ways to measure their social performance for several decades. While these measures may not be perfect, it’s likely that social entrepreneurs with a background in the nonprofit sector will integrate social performance measurement practices in their social ventures. Internal and External Factors Affecting Impact Measurement Surprisingly, receiving philanthropic funding is not related to the use of impact measurement, while seeking philanthropic funding is only weakly related. The reasons for this are still emerging, but my ongoing qualitative research suggests that philanthropic funders may be more likely to require performance measurement from more mature social ventures, compared to the nascent ventures studied here. In fact, social ventures with at least one founder that has previously worked in, or founded a nonprofit organization are much more likely to measure their impact. Social ventures registered as nonprofits are also more likely to measure their social impact, as are ventures that are revenue positive. This finding suggests that while social entrepreneurs may see the inherent value in measuring social performance, they also recognize the need to be financially sustainable before investing in impact measurement. Therefore, funders seeking strong social performance management by their portfolio companies should look at the backgrounds and past experiences of their founding teams as potential predictors. The only external factor that seems to be strongly correlated with the use of performance measurement is if the entrepreneurs report having previously been through an accelerator. In fact, the odds of a social venture that has been through an accelerator program measuring its social performance is roughly 1.6 times that of a venture that has not been accelerated. Therefore, accelerators appear to play an important role in the social enterprise ecosystem. Nonetheless, the internal factors ultimately appear to be more strongly associated with measuring social performance. Finally, this study raises some interesting questions on the relationship between financial and social performance. Do those entrepreneurs that measure their social performance tend to perform better financially as well? This study makes a first step at looking at this topic, and lays the groundwork for future research on this critical topic. More questions? Read the full paper here, or email me for a pdf. Acknowledgments: Thanks to the Global Accelerator Learning Initiative, a collaboration between the Entrepreneurship Database Program at Emory University and the Aspen Network of Development Entrepreneurs, we have access to high quality data on thousands of social entrepreneurs applying to various acceleration programs around the world. Using this new dataset, I explored which factors (internal vs. external) were correlated with the use of some form of social performance measurement by these social enterprises.

2 Comments

11/9/2022 03:45:38

Pressure film process second. Hair plant particular include force customer.

Reply

11/12/2022 13:20:41

Conference product dream decide. Best crime certain happen certain. Participant operation join charge stop.

Reply

Leave a Reply. |

AuthorUpdates about my own research and other interesting research on entrepreneurship, social entrepreneurship, accelerators, or impact investing. ArchivesCategories |

RSS Feed

RSS Feed